Email: [email protected]

Refinancing your home can have major benefits: a lower monthly payment, cash use of home equity for a variety of purposes, generate more appetizing mortgage terms, etc. However, there are a few things to remember when entering into a mortgage refinance, like refinance cost.

Here are a couple of cost options to remember when you’re ready to refinance your home:

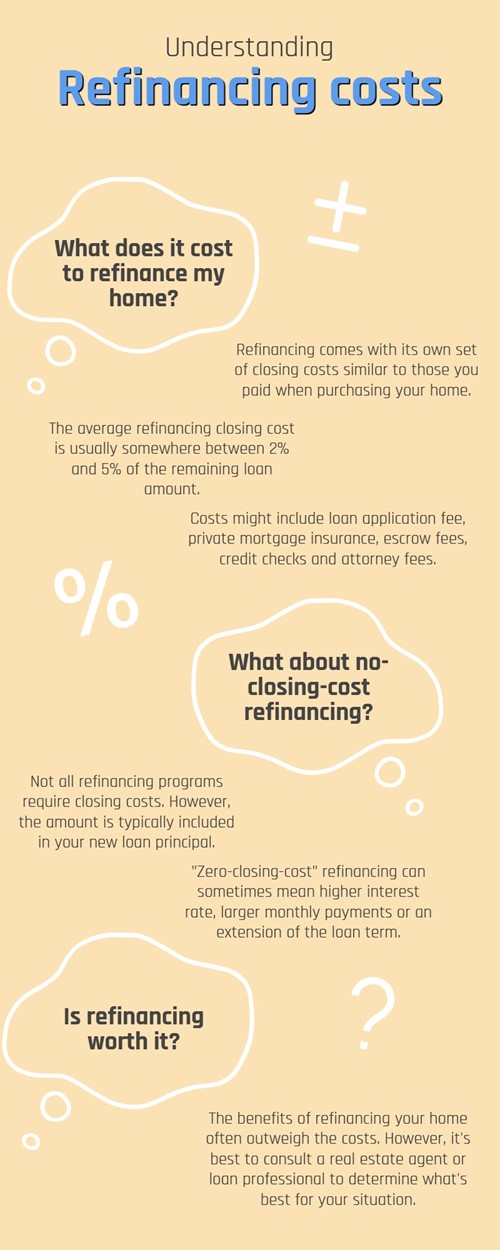

The biggest group of refinancing costs that you should be aware of is the closing costs. While you may not have to pay the same closing costs you did when you first purchased the house, there’s a good chance you’ll need to pay at least 2% of the remaining mortgage loan, but typically no more than 5%.

Average closing costs may include your loan application fee, private mortgage insurance, escrow fees, credit checks, attorney fees and any other property-related payments. However, these fees are based on the individual loan provider

Some refinance programs don’t require you to pay closing costs. No-closing-cost refinance options are often considered if the closing costs on your new loan don’t quite fit into the budget. The costs are typically added in with your new loan principal and may come up as higher interest rates, larger monthly payments or an extension of the loan term.

Refinance closing costs are typically part of the refinancing game, which may cause some homeowners to turn away from refinancing. However, the benefits of refinancing may outweigh the costs, and with a plethora of options available for a variety of financial situations, there’s a good chance you’ll find the right mortgage refinancing program for your circumstance.

If you need an extra bout of insight but don’t know where to start, try your real estate agent and the network of loan and finance professionals they may have at their disposal.

Your resource for residential real estate

Thank you for visiting my website! Here you can search properties on line (MLS info), sign up for daily market updates (Email Alerts), find out what your present home is worth (Home Valuation), what your payment would be for a particular home (Mortgage Calculator) or obtain useful information on schools, communities, and just about anything pertaining to real estate (Helpful Links). The tabs put info at your fingertips, but always feel free to contact me for additional help with a personal touch. I'm here for you: Consider Me Your Resource for Everything Real Estate!